How to Prepare Master Budget ( Budgeting)

There are 10 steps to prepare master budget as follows:

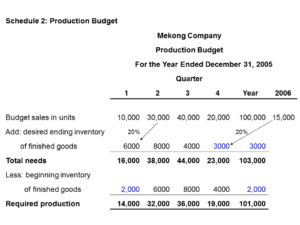

1.Sale budget and schedule expected cash collections

2.Production budget

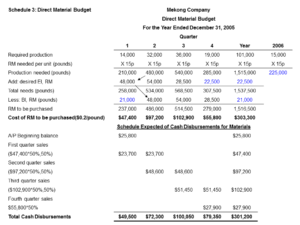

3.Direct materials budget and expected cash disbursements

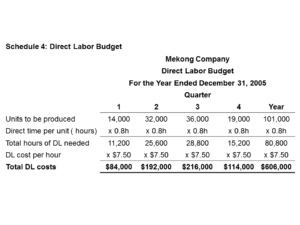

4.Direct labor budget

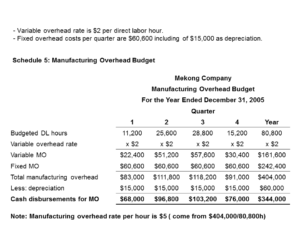

5.Manufacturing overhead budget

6.Ending finished goods inventory budget

7.Selling and admin. budget

8.Cash budget

9.Budgeted income statement

10.Budgeted balance sheet

Example fore preparing master budget as follows.

Manager of Mekong Company needs to prepare master budget for 2005, and balance sheet for 2004 is as follows:

|

Mekong Company |

||

|

Balance Sheet |

||

|

December 31, 2004 |

||

| Assets | ||

| Current assets: | ||

| Cash | $42,500 | |

| Account Receivable | 90,000 | |

| Raw materials inventory (21,000 pounds) | 4,200 | |

| Fished goods inventory (2,000 units) | 26,000 | |

| Total current assets | $162,000 | |

| Plant and equipment | ||

| Land | 80,000 | |

| Building and equipment | 700,000 | |

| Accumulated depreciation | (292,000) | |

| Plant and equipment, net | 488,000 | |

| Total assets | $650,700 | |

| Liabilities and Stockholders’ Equity | ||

| Current liabilities: | ||

| Account payable ( raw material) | $ 25,800 | |

| Stockholders’ equity | ||

| Capital | $175,000 | |

| Retained earnings | 449,900 | |

| Total stockholders’ equity | 624,900 | |

| Total liabilities and Stockholders’ equity | $650,700 | |

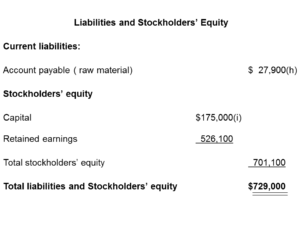

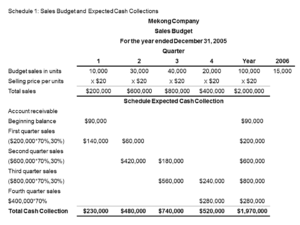

I. Sales Budget and Expected Cash Collections

- Assume that Mekong estimates expected sales for 2005 are 100,000 units, and these sales are 10,000 units, 30,000 units, 40,000 units, and 20,000 units for the first, second, third, and fourth quarter, respectively.

- Expected sales for the first quarter in 2006 are 15,000 units.

- Selling price per unit is $20.

- For cash collection policy, 70% of sales are collected in the quarter of sale, and 30% in the following sale quarter.

II. Production Budget

| Prepare a production budget | |

| Budget sales in units | XXX |

| Add: desired ending inventory | XXX |

| Total needs | XXX |

| Less: beginning inventory | XXX |

| Required production | XXX |

Assume Mekong desires ending inventory of finished goods of each quarter equal to 20% of the next quarter’s sales.

III. The Direct Material Budget

| Prepare a direct material budget | |

| Raw materials needed for production | XXX |

| Desired ending inventory of raw materials | XXX |

| Total raw materials needs | XXX |

| Less: beginning inventory of raw materials | (XXX) |

| Raw materials to be purchased | XXX |

| Cost of RM to be purchased | XXX |

- Each unit requires 15 pounds of raw material costing $0.20 per pound.

- Desired ending inventory of raw materials is 10% of the next quarter’s production needed.

- Purchases of raw materials are paid for in the following pattern: 50% paid in the quarter the purchases are made, and the remaining 50% paid in the following quarter.

- Required production for the first quarter in 2006 is 15,000 units.

VI. The Direct Labor Budget

Each unit requires 0.8 h, and direct labor cost per hour is $7.50.

V. The Manufacturing Overhead Budget

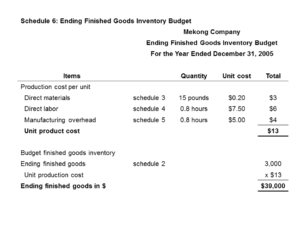

VI. The Ending Finished Goods Inventory Budget

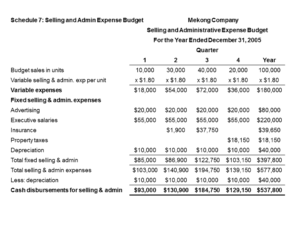

VII. The selling and Administrative Expense Budget

– Variable selling & admin per unit is $1.80.

– Advertising and executive salaries per quarter are $20,000 and $55,000, respectively.

– Insurances for second and third quarter are $1,900 and $ 37,750, respectively.

– Property taxes for fourth quarter are $18,150, and depreciation per quarter is $10,000.

Depreciation for building per quarter is $10,000.

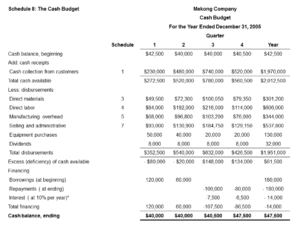

VIII. The Cash Budget

There are four sections in cash budget as follows:

1.The receipts section

2.The disbursements section

3.The cash excess or deficiency section

4.The financing section

The form of the cash budget is defined as follows:

| Basis form of cash budget | |

| Cash balance, beginning | $XXX |

| Add: cash receipts | XXX |

| Total cash available | XXX |

| Less: cash disbursements | XXX |

| Excess ( deficiency) of cash available over cash disbursements | XXX |

| Financing | XXX |

| Cash balance, ending | $ XXX |

Mekong Company prepares cash budget for each quarter in 2005 related with items as follows:

- Company will purchase equipment of $130,000, and this amount paid of $50,000, $40,000, $20,000, and $20,000 for first, second, third, and fourth quarter, respectively.

- Dividends of $8,000 are to paid in each quarter.

- For deficiency of cash, company will borrow cash at beginning of quarter, and pay principals and interests at ending of quarter in case of enough cash.

- Interest rate per year is 10%.

- Company wants to maintain a minimum quarterly cash balance of $40,000.

*100,000 x 2%/12 x 9=7,500$

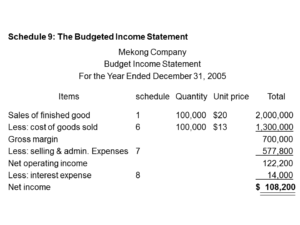

IX. The Budgeted Income Statement

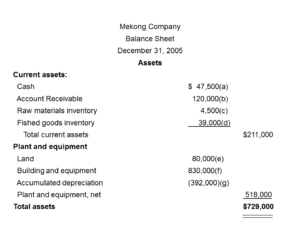

X. The Budgeted Balance Sheet (Schedule 10)

Explanation of December 31, 2005, balance sheet figures:

a. The ending cash balance, as projected by the cash budget in Schedule 8.

b. 30% of 4th quarter sales, form schedule 1 ($400,000 *30% = 120,000).

c. From schedule 3, the ending raw materials inventory will be 22,500 pounds. This material costs $0.20 per pound. 22,500 x 0.2 = $4,500

d. From schedule 6

e. From the December 31, 2004, balance sheet.

f. The December 31, 2004, balance sheet indicated a balance of $700,000. During 2005, $130,000 additional equipment will be purchased ( schedule 8).

g. The December 31, 2004, balance sheet indicated a balance of $292,000. During 2005, $100,000 of depreciation will be taken ( $600,000 on schedule 5 and $40,000 on schedule 7).

h. One half of the 4th quarter raw materials purchases, from schedule 3.

i. From the December 31, 2004.

*** Phnom Penh HR is the best recruitment and consulting in Cambodia and Asia , and our services by ACCA | CPA, Diploma in Cambodia Tax, Tax Agent and MBA.

*** Please contact Phnom Penh HR now via 093 682 682 | 078 868 848 | info@pp-hr.com

Source:

- Phnom Penh HR

- Mcgraw-Hill