IAS 2 Inventory

Scope

The following items are excluded from the scope of the standard.

•Work in progress under construction contracts (covered by IAS 11 Construction contracts)

•Financial instruments (ie shares, bonds)

•Biological assets

Definitions

Inventories are assets:

– Held for sale in the ordinary course of business;

– In the process of production for such sale; or

– In the form of materials or supplies to be consumed in the production process or in the rendering of services.

Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. (IAS 2)

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (IFRS 13)

Inventories can include any of the following.

Goods purchased and held for resale, eg goods held for sale by a retailer, or land and buildings

held for resale

Finished goods produced

Work in progress being produced

Materials and supplies awaiting use in the production process (raw materials)

Measurement of inventories

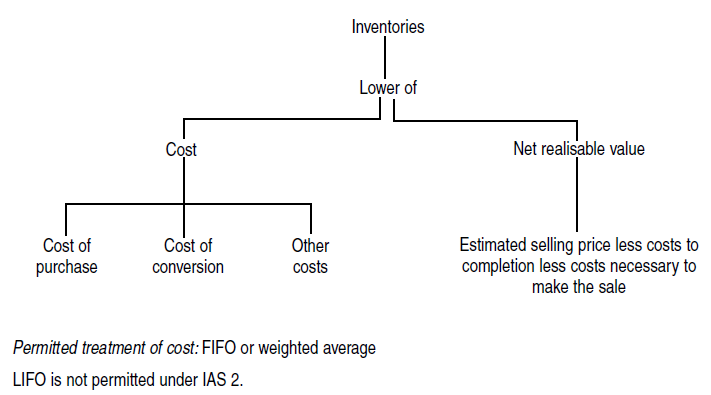

The standard states that ‘Inventories should be measured at the lower of cost and net realisable value.’

Cost of inventories

The cost of inventories will consist of all costs of:

Purchase

Costs of conversion

Other costs incurred in bringing the inventories to their present location and condition

Costs of purchase

The standard lists the following as comprising the costs of purchase of inventories.

Purchase price PLUS

Import duties and other taxes PLUS

Transport, handling and any other cost directly attributable to the acquisition of finished goods, services and materials LESS

Trade discounts, rebates and other similar amounts

Costs of conversion

Costs of conversion of inventories consist of two main parts.

(a) Costs directly related to the units of production, eg direct materials, direct labour

(b) Fixed and variable production overheads that are incurred in converting materials into finished goods, allocated on a systematic basis.

The standard emphasises that fixed production overheads must be allocated to items of inventory on the

basis of the normal capacity of the production facilities. This is an important point.

(a) Normal capacity is the expected achievable production based on the average over several periods/seasons, under normal circumstances.

(b) The above figure should take account of the capacity lost through planned maintenance.

(c) If it approximates to the normal level of activity then the actual level of production can be used.

(d) Low production or idle plant will not result in a higher fixed overhead allocation to each unit.

(e) Unallocated overheads must be recognised as an expense in the period in which they were incurred.

(f) When production is abnormally high, the fixed production overhead allocated to each unit will be reduced, so avoiding inventories being stated at more than cost.

(g) The allocation of variable production overheads to each unit is based on the actual use of production facilities.

Other costs

Any other costs should only be recognised if they are incurred in bringing the inventories to their present location and condition.

The standard lists types of cost which would not be included in cost of inventories. Instead, they should be recognised as an expense in the period they are incurred.

(a) Abnormal amounts of wasted materials, labour or other production costs

(b) Storage costs (except costs which are necessary in the production process before a further production stage)

(c) Administrative overheads not incurred to bring inventories to their present location and conditions

(d) Selling costs

Techniques for the measurement of cost

Two techniques are mentioned by the standard, both of which produce results which approximate to cost, and so both of which may be used for convenience.

(a) Standard costs are set up to take account of normal production values: amount of raw materials used, labour time etc. They are reviewed and revised on a regular basis.

(b) Retail method: this is often used in the retail industry where there is a large turnover of inventory items, which nevertheless have similar profit margins. The only practical method of inventory valuation may be to take the total selling price of inventories and deduct an overall average profit margin, thus reducing the value to an approximation of cost. The percentage will take account of

reduced price lines. Sometimes different percentages are applied on a department basis.

Cost formulae

Specific identification of their individual costs

Cost of inventories should be assigned by specific identification of their individual costs for:

(a) Items that are not ordinarily interchangeable

(b) Goods or services produced and segregated for specific projects

Specific costs should be attributed to individual items of inventory when they are segregated for a specific

project, but not where inventories consist of a large number of interchangeable (ie identical or very

similar) items.

Interchangeable items

The cost of inventories should be assigned by using the first-in, first-out (FIFO) or weighted average cost formulas. The LIFO formula (last in, first out) is not permitted by IAS 2.Under the weighted average cost method, a recalculation can be made after each purchase, or alternatively only at the period end.

Net realisable value (NRV)

Net realisable value (NRV) = Estimated selling price less costs to completion less costs necessary to make the sale

In fact we can identify the principal situations in which NRV is likely to be less than cost, ie where there has been:

(a) An increase in costs or a fall in selling price

(b) A physical deterioration in the condition of inventory

(c) Obsolescence of products

(d) A decision as part of the company’s marketing strategy to manufacture and sell products at a loss

(e) Errors in production or purchasing

A write down of inventories would normally take place on an item by item basis, but similar or related items may be grouped together.The assessment of NRV should take place at the same time as estimates are made of selling price, using the most reliable information available.

Some inventory, for example, may be held to satisfy a firm contract and its NRV will therefore be the contract price. Any additional inventory of the same type held at the period end will, in contrast, be assessed according to general sales prices when NRV is estimated.

If the NRV has risen for inventories held over the end of more than one period, then the previous write down must be reversed to the extent that the inventory is then valued at the lower of cost and the new NRV.

Recognition as an expense

The following treatment is required when inventories are sold.

(a) The carrying amount is recognised as an expense in the period in which the related revenue is recognised.

(b) The amount of any write-down of inventories to NRV and all losses of inventories are recognised as an expense in the period the write-down or loss occurs.

(c) The amount of any reversal of any write-down of inventories, arising from an increase in NRV, is recognised as a reduction in the amount of inventories recognised as an expense in the period in which the reversal occurs.

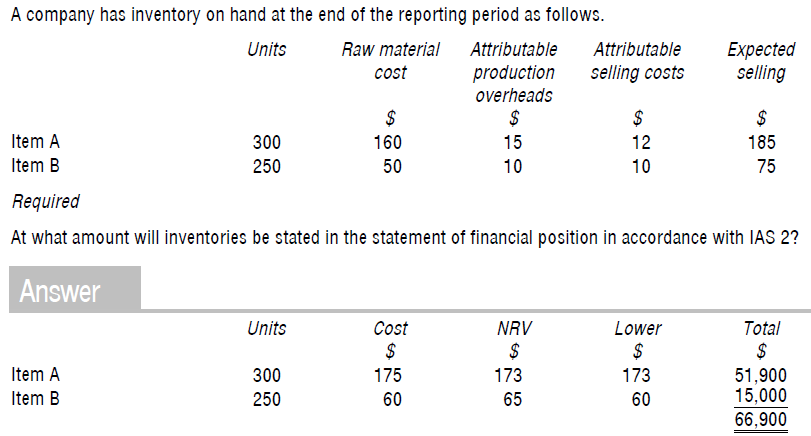

Example:

Consistency

IAS 2 allows two cost formulas (FIFO or weighted average cost) for inventories that are ordinarily interchangeable or are not produced and segregated for specific projects.

IAS 2 provides that an entity should use the same cost formula for all inventories having similar nature and use to the entity. For inventories with different nature or use (for example, certain commodities used in one business segment and the same type of commodities used in another business segment), different cost formulas may be justified. A difference in geographical location of inventories (and in the respective tax rules), by itself, is not sufficient to justify the use of different cost formulas.

Source: ACCA, F7 Financial Reporting by BPP