Cost of Fixed asset may occur via two ways : buying and self construction.

1.Buying Fixed Asset

Cost of fixed asset = purchase price-trade discount-sale return and allowance+ freight + insurance + import taxation + Specific tax (if any) + VAT Input ( if we cannot claim VAT input)+port fee + clearance cost + handling cost + other relevant costs

Note:

- Settlement discount because of early payment is excluded cost of fixed asset, so it is other income.

- VAT input is excluded cost of fixed asset if it can be claimed from VAT output, but included as cost of fixed asset when we cannot claim with VAT input.

Example 1

ABC is a company in K Country, and ABC Company imported car from another country for general admin use. The assumption costs of car are as follows.

Purchase price……………………………$25,000

Import tax…………………………………$5,000

Specific tax………………………………..$2,500

VAT input from car importation…$3,250(*)

Bank fees transferred to suppliers…$50

Port fee …………………………………….$50

VAT Input………………………………….$5

Clearance cost fee ……………………..$100

Transportation in……………………….$500

VAT input………………………………….$60

Handling cost…………………………….$50

Public Relation cost……………………$40

Required:

*We assume VAT input from car importation cannot be claimed. Calculate total cost of fixed asset (car).

Answer

VAT Input from car importation cannot be claimed, so it is cost of fixed assets, but VAT input can be claimed, so it is not cost of fixed asset.

Public relation cost of $40 is excluded cost of fixed asset.

Cost of Fixed Asset (car) =25,000 +5,000+2,500+3,250+15+50+100+500+50= $36,465

2.Self Construction Fixed Asset

Sometime company may construct own building, machinery, factory etc.

Cost of own construction fixed asset = material + labour + overhead

Example 2

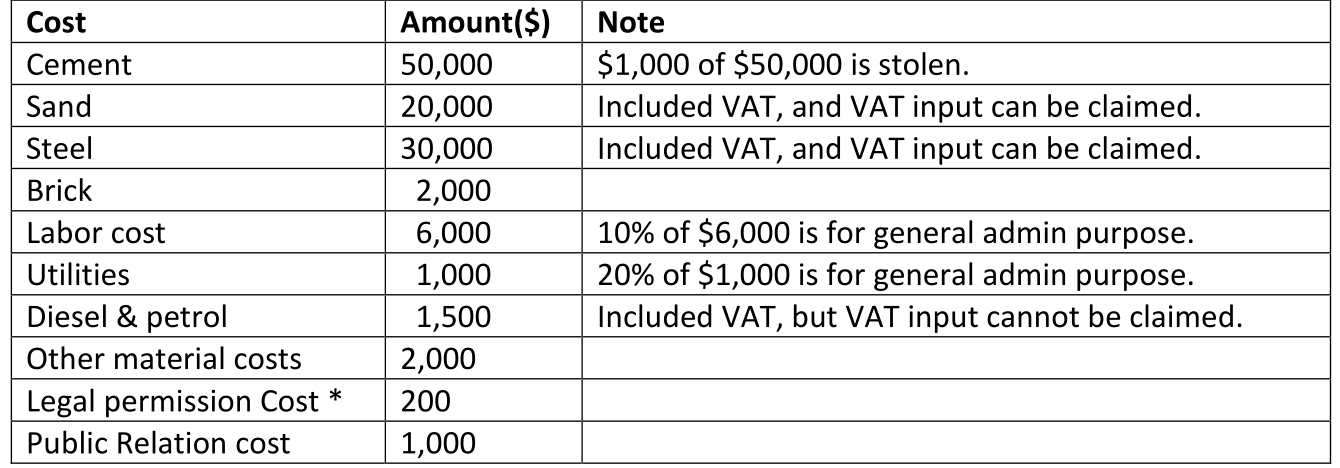

Your company at XYZ Country constructs an admin building for use. The assumption costs for construction are as follows.

*Legal permission cost from authority for constructionAssume that Value-Added Tax (VAT) is rate @ 10%.

Required:

- You are required to calculate cost of building.

- Calculate VAT input if any.

- Calculate Admin Cost

- Other expenses

Solution

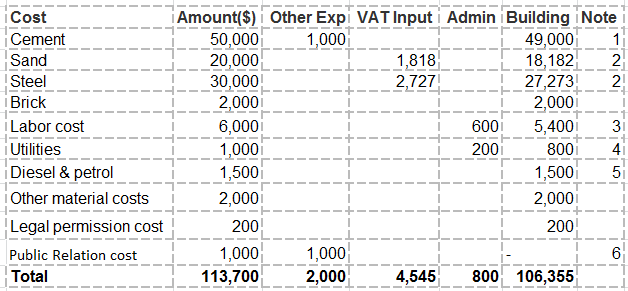

Note (1) : $1,000 is abnormal cost, so accounting standard does not recognize it as cost of asset, but it is other expense.

Note (2) : VAT input can be claimed from tax authority, so it is not cost of fixed asset.

Note (3) : 20% of labour is used for general admin, so it is not used for fixed asset construction.

Note (4) : 20% of utilities is used for general admin, so it is not used for construction.

Note (5) : VAT input from diesel & petrol cannot be claimed, so VAT input is cost of fixed asset.

Note (6): public relation cost may be inappropriate cost as cost of fixed asset.

Below are answers for questions above.

- You are required to calculate cost of building=$ 106,355

- VAT input ( can be claimed) = $4,545

- Admin Cost=$800

- Other expenses=$2,000