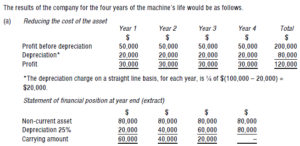

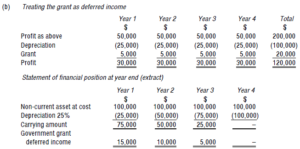

IAS 20 ACCOUNTING FOR GOVERNMENT GRANTS AND DISCLOSURE OF GOVERNMENT ASSISTANCE :

Question:

A company receives a 20% grant towards the cost of a new item of machinery, which cost $100,000. The machinery has an expected life of four years and a nil residual value. The expected profits of the company before accounting for depreciation on the new machine or the grant, amount to $50,000 per annum in each of the machinery’s life.

Required:

Prepare extracts of income statement and statement of financial position if:

- Grant reducing the cost of asset

- Grant as deferred income

Answer :

Source: BPP