Present Value with Uneven Cash Flows-Ordinary Present Value

Present value with uneven cash flows will be deposited or invested today with appropriate discount rate, and after that different uneven cash flows will be received during more than one period.

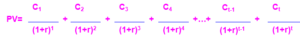

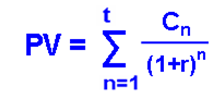

There are often four parts to equation (time value of money for multiple cash flows): the present value (PV), the future value (FV), the discount rate (r), and the number of periods of the investment (t). If three of these (FV, r and t) are given, so we can find the present value (PV).

The ordinary cash flows occur at the end of each period.

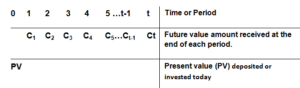

Time Line

Which:

- PV: Ordinary Present Value

- Cn (n=1,2,3,4,…,t) : future value or amount received for the end of each period.

- 1/(1+r)t: present value interest factor or present value factor for 1$ at r percent for t periods.

Question

AXZ Company wants to purchase stock from YTZ Company, and company will plan to sell the stock in four years. AXZ estimates that the stock will be worth $60 at that time. Company predicts that the stock will also pay $8, $10, $11 and $14 per share dividend at the end of the each year. If AXZ require 15 percent return on investment. What is the current value of the stock that AXZ Company should purchase from YTZ Company?

Solution

PV=8/(1+0.15)1+10/(1+0.15)2+11/(1+0.15)3+74/(1+0.15)4

PV=$64

So the current value of the stock is $64