The figures are filled in these tax forms explained at end of tax forms.

សូមចុចលើរូបភាពខាងក្រោមដើម្បីមើលច្បាស់

Assume we will declare monthly tax for February 2018, so the following steps will fill to submit to tax officer.

1.We will record sale for February 2018 the same as table below.

Information included Date, Invoice Number, Client (customers), VAT No. , Description, Quantity (Qty) Sold etc.

2.We will record salary for February 2018 the same as table below.

Information included Employee Names,Nationality,Functions, Salary , Spouse, Minor Children etc.

3.We will record purchase and expense for February 2018 the same as table below.

Information included Date, Invoice Number,Suppliers Name, VAT No. , Description, Quantity (Qty) purchased etc.

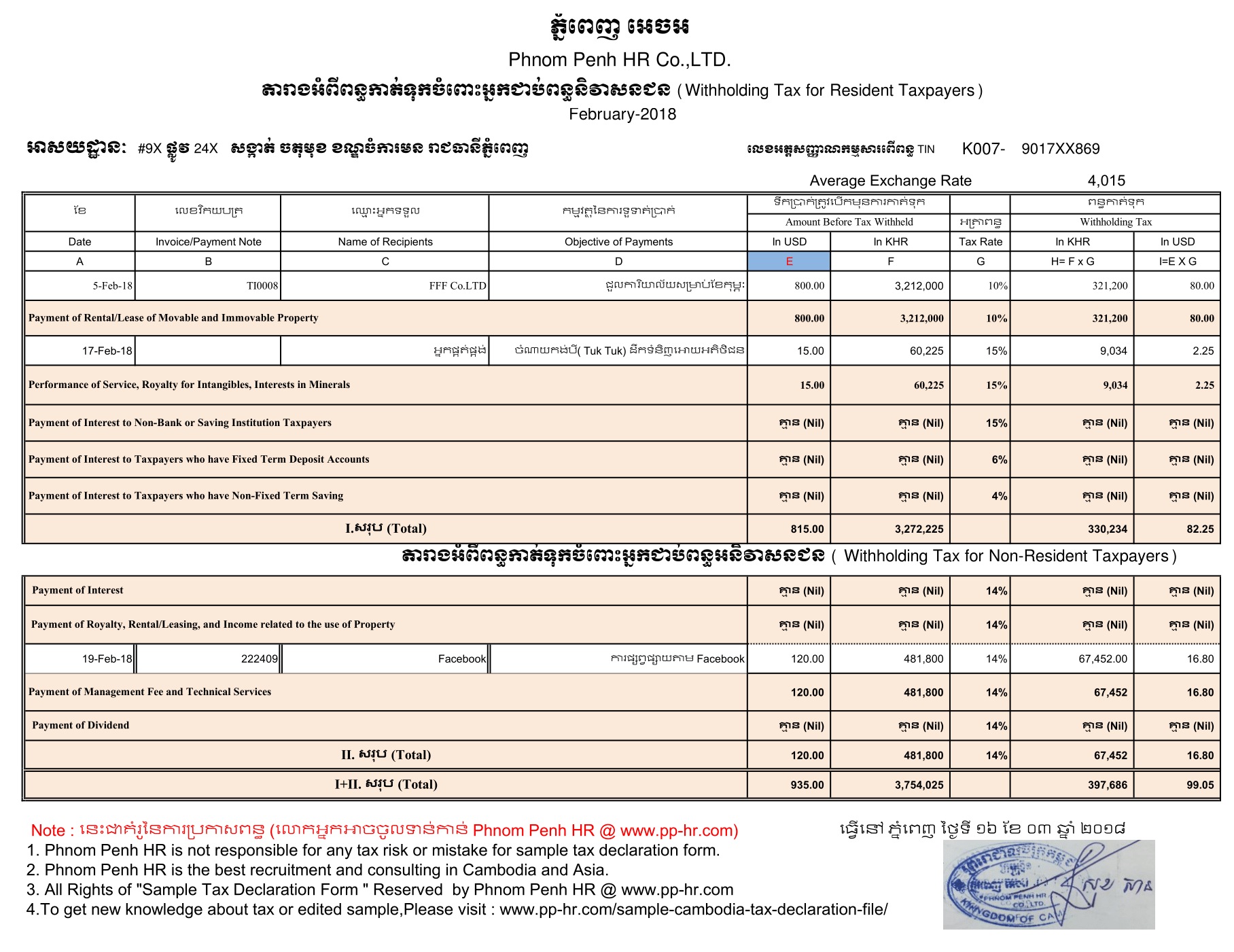

4.We will record withholding tax information for February 2018 the same as table below.

Information included Date, Invoice Number, Name of Recipient, Objective of Payment etc.

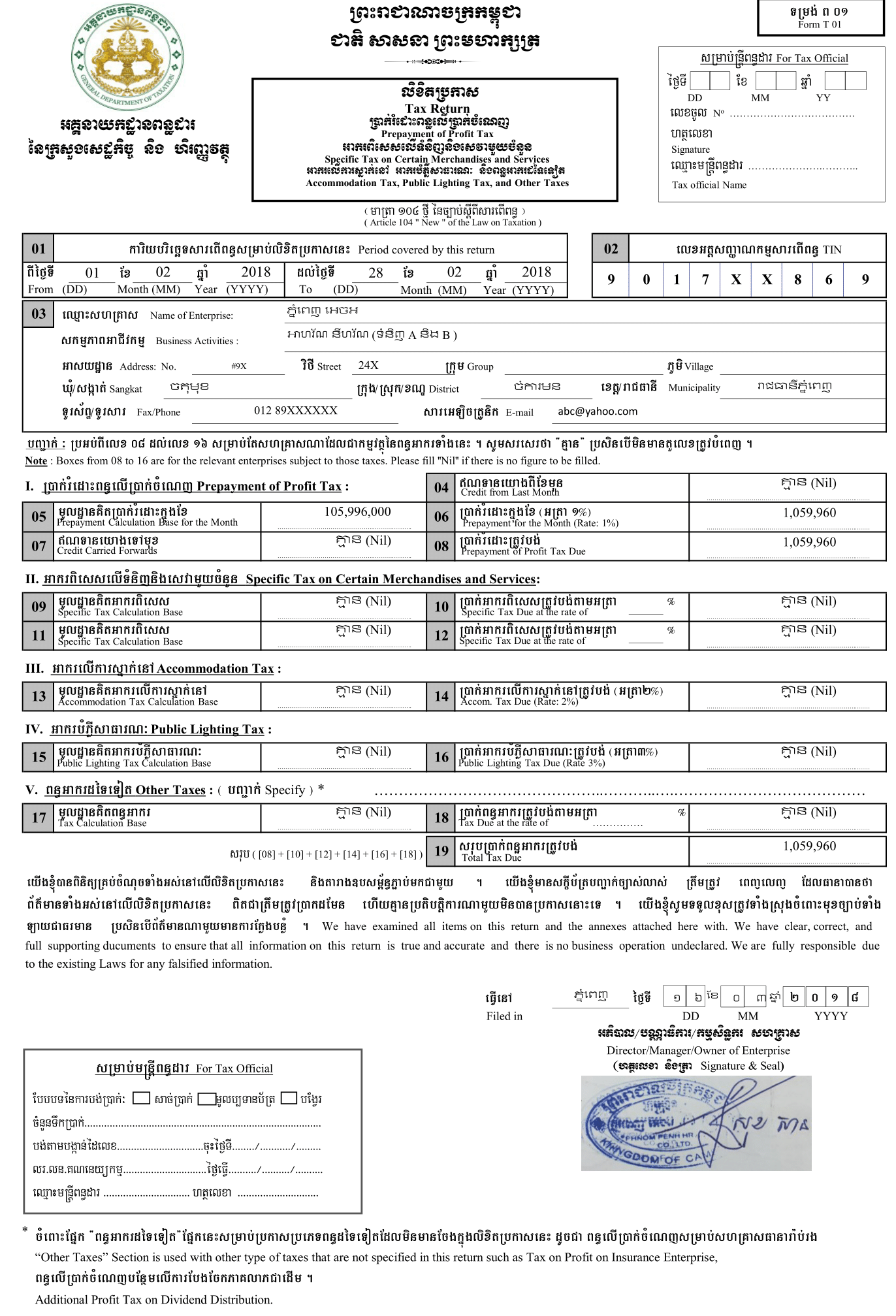

5.We will fill sale information above for February 2018 the same as tax Form T 01 below.

Taxes for Form T 01 included Prepayment of Profit Tax, Specific tax on certain merchandises and services, accommodation tax, pubic lighting tax etc.

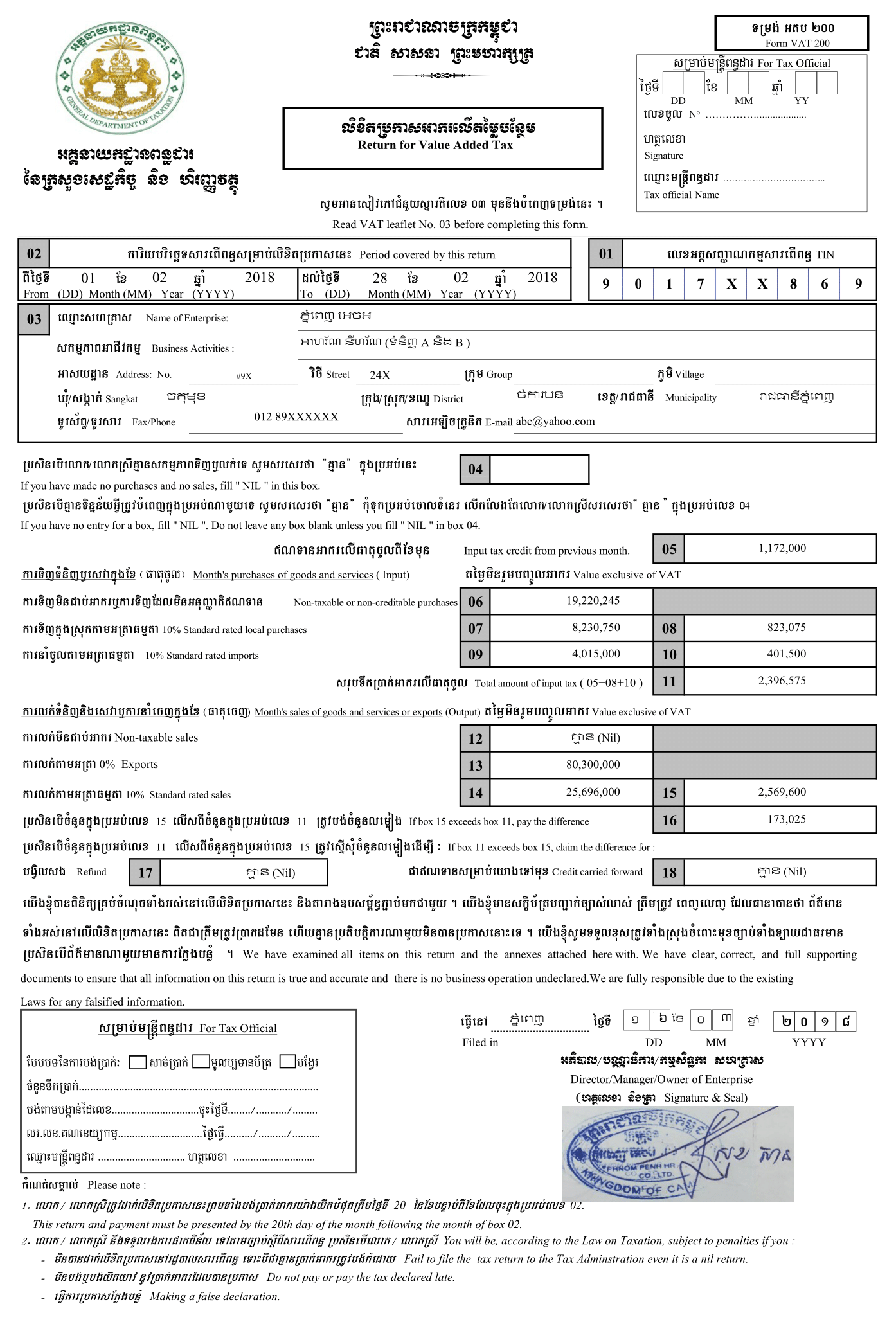

6.We will fill sale and purchase information above for February 2018 the same as tax Form VAT 200 below.

Information for Form VAT 200 included Input Tax Credit from Previous Month ( beginning VAT credit), VAT input during month , VAT output during month etc.

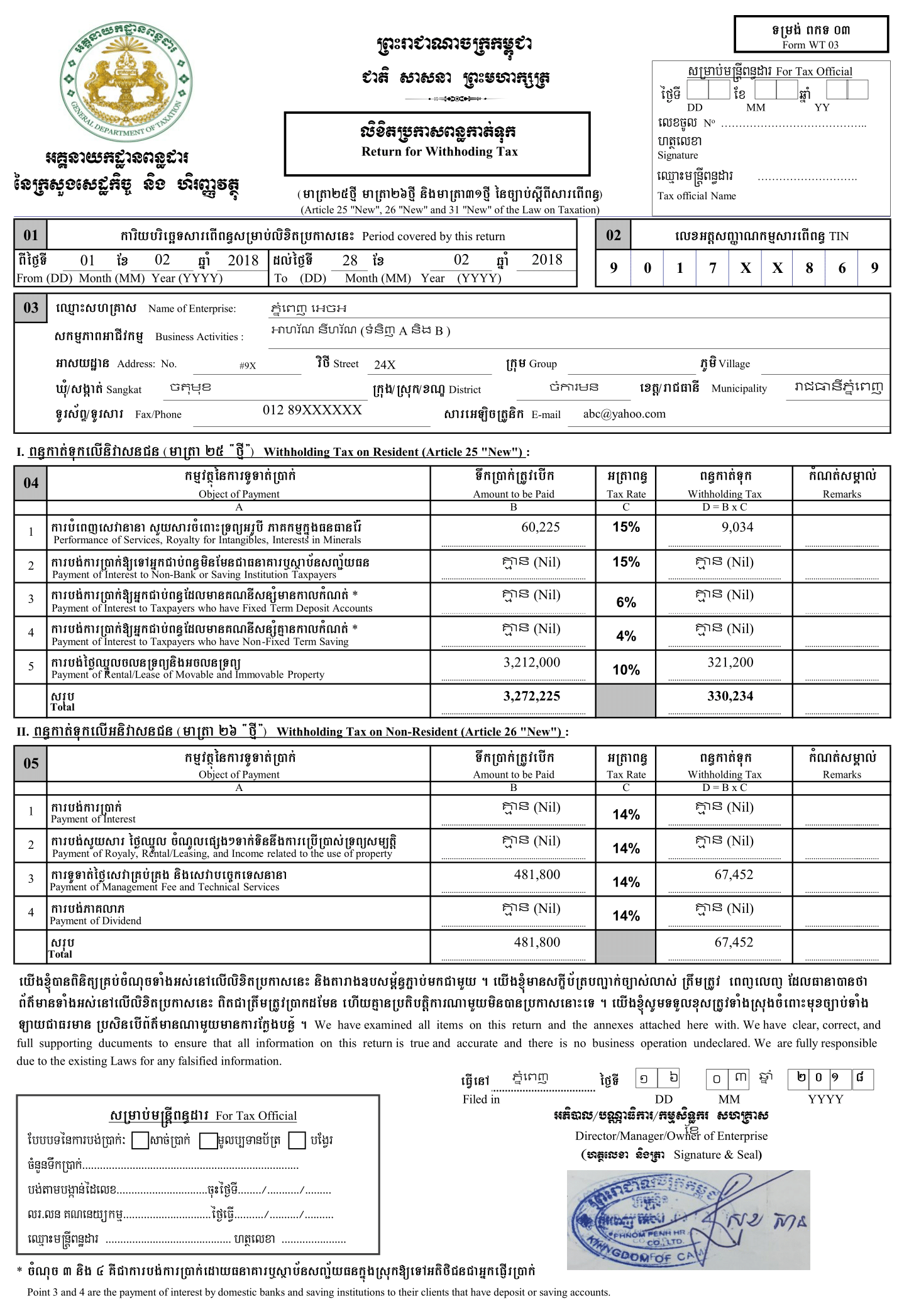

7.We will fill expense information relevant to withholding above for February 2018 the same as tax Form WH 03 below.

Taxes for WH 03 included withholding tax on resident ,withholding tax on non-resident etc.

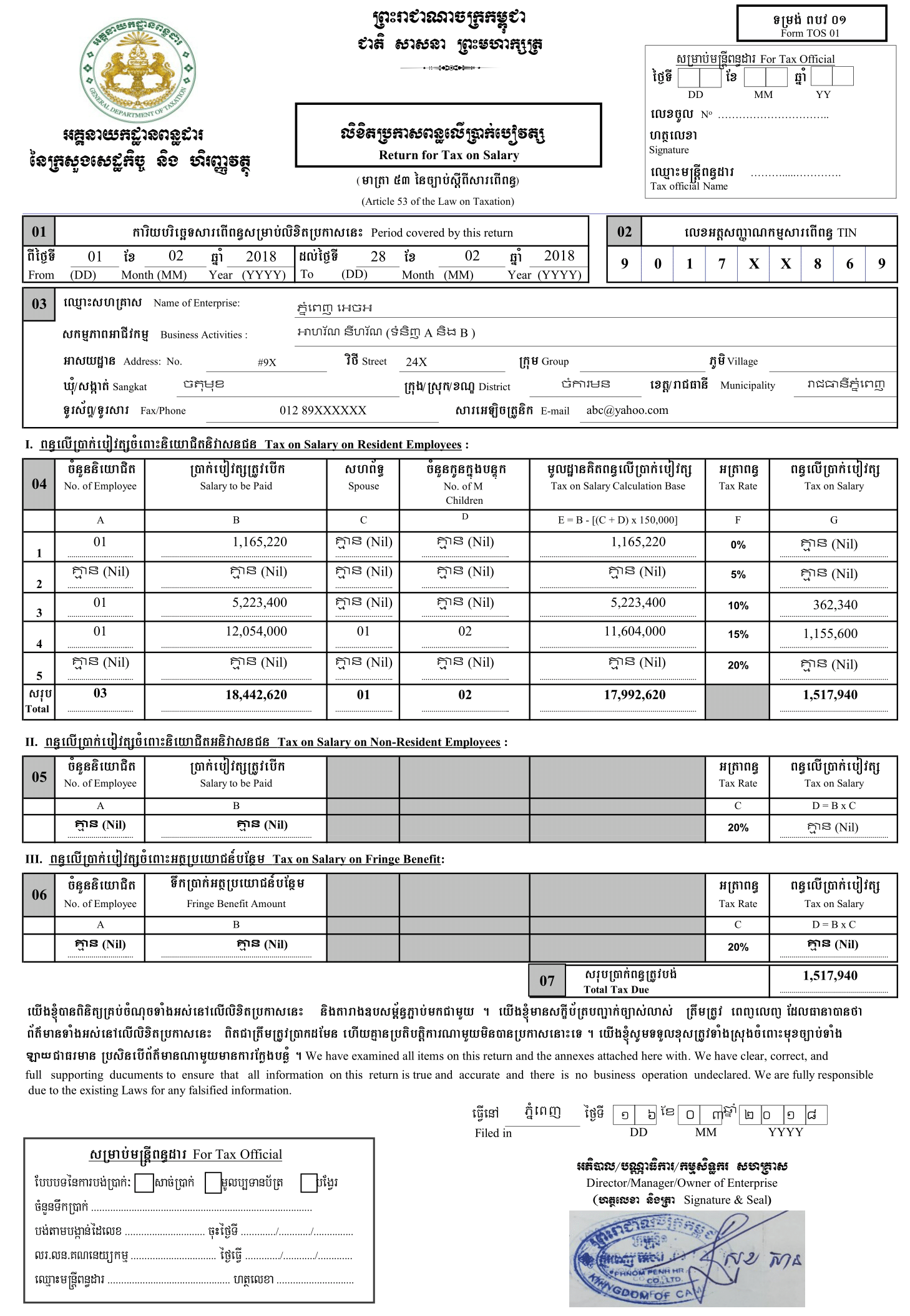

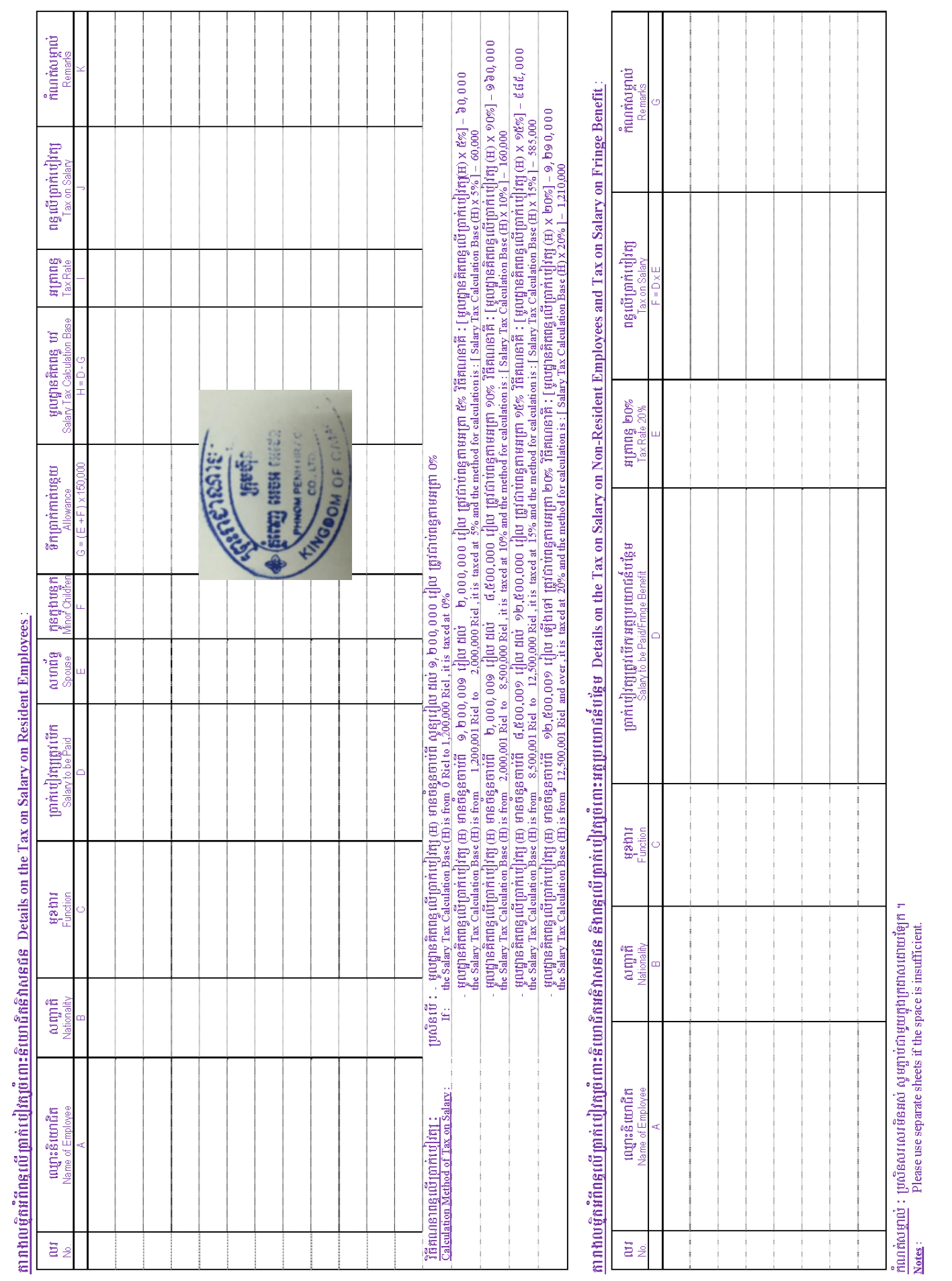

8.We will fill salary information for February 2018 the same as tax Form TOS 01 below.

Taxes for Form TOS 01 included tax on salary on resident Employees , Tax on salary on non-resident Employees etc.

Below are explained about figures filled in tax forms above.

Phnom Penh HR is import and export company for Product A and B. The following transactions for monthly tax declaration are as follows.

Sale Information:

– 15 February,2018 : Sold 10 units of Product A to XYZ Co., LTD (VAT Number: L001-100XXXX92 ) for $6,600 including VAT ( tax invoice#TI18-0001)

-17 February,2018: Sold 1 unit of Product B to Customer A (user) for $440 including VAT ( commercial invoice #IN18-0001).

-17 February,2018: Exported 48 units of Product B to Customer DEF for $20,000 , VAT @ 0% ( invoice #IN18-0002).

Salary Information :

-Mr. A, Manager : Salary of $3,000 per month, but he has two minor children and wife is housewife.

-Ms.B,Sale officer : salary of $290 per month.

-Mr.C, Accounting Manager : Salary of $1,300 per month.

Purchase and Expense information:

-5 February 2018: office rental of $880 including VAT ( tax invoice #TI0008) charged by FFF Co.LTD ( VAT Number: K003-10XXXX403).

-5 February 2018: electricity expense of $30 exemption of VAT ( invoice #IN0005) charged by FFF Co.LTD ( VAT Number: K003-10XXXX403).

-14 February 2018: imported Product A ( 2 units) of $1,100 including VAT ( Customs Declaration Number #I115X3) and customs charged other services of $18.68.

-14 February 2018: bought office supply of $10 from KKK shop ( invoice # 899)

-15 February 2018: purchased Product B ( 5 units) of $1,375 including VAT (tax invoice #0015) from BBA Co.LTD ( VAT Number: K003-10XXXX111).

-17 February 2018: transportation of goods to customers via Tuk Tuk of $15 .

-19 February 2018: advertising via Facebook of $120 ( invoice#222409).

Monthly Exchange Rate Information:

-Salary exchange rate for February: $1=4018 KHR

-Average Exchange rate for February: $1 =4015 KHR

VAT Information:

VAT credit ( beginning balance) brought from January 2018 is 1,172,000 KHR.

Note:

-All of Sample Tax Declaration forms above are rights reserved by Phnom Penh HR, the best recruitment & consulting firm in Cambodia and Asia.

-In practice, Tax Declaration forms may be different styles.