Present Value of Single Cash Flow for Multiple Periods with Frequency Compound Interest

Present Value with a Single Cash Flow:

Present value (PV) is the current value of a single future cash flow discounted at the appropriate discount rate.

Time value of money for a single cash flow is a cash inflow or outflow that investors or lenders received from or paid to once respectively for specific periods

There are often four parts to equation (time value of money for a single cash flow): the present value (PV), the future value (FV), the discount rate (r), and the number of periods of the investment (t). If three of these (FV, r and t) are given, so we can find the present value (PV).

Multiple-Period Investment:

Multiple-period investment may be investment for more than one year. Term multiple-period can refer to more than one day or one month investment, so it isn’t always more than one year investment.

If period investments are based on one day, one month or one year etc., so discount rates are based on one day, one month or one year respectively.

Definition of Frequency Compound Interest:

The compounding frequency is the number of times per year the accumulated interest is paid out on a regular basis. The frequency could be yearly, half-yearly, quarterly, monthly, weekly, daily etc.

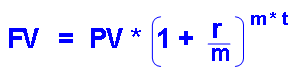

Formula of Future Value with Compounding Frequency for Multiple-Period Investment:

PV=FV/(1+r/m)^m*t

Which

PV: Present Value or principal is worth today

FV: Future value is worth in the future

r : Interest rate, rate of return, or discount rate per period , but not always one year.

t : time is referred to number of years (but not always year) of investment

m: Compounding Frequency:

- If compound yearly, then m=1

- If compound semiannually, then m=2

- If compound quarterly, then m=4

- If compound monthly, then m=12

- If compound daily, then m=365

r/m: it is called rate per compounding period (i), so let i =r/m

m x t: it is called numbers of periods in t years, so let N= m x t

Question

Mr. AA wants to get $7,430 after five years, and how much he invests today at bank with annual interest rate of 8 percent per year, compounded quarterly.

Solution

PV=FV/(1+r/m)^m*t

FV=$7,430

r=8%

m=4 ( one year = 4 quarters)

PV= 7,430/ (1+8%/4) ^(4×5)=$5,000

So Mr. AA deposits $5,000 today to get get $7,430 after five years.